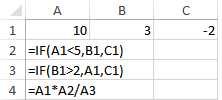

What is the value of cell A4?

a) -6.67

b) -15

c) 10

d) 3

e) -2

e) -2

You might also like to view...

Which of the following is NOT a barrier to listening?

A. listening-speaking differential B. motivation C. demographics D. willingness

Wright Company contracted with the city of St. Louis to train and employ disadvantaged youths. If Wright fails to fulfill the contract and is sued by one of the disadvantaged youths, the youth would

a. win, as he is an intended beneficiary. b. win, as he is a donor beneficiary. c. lose, as he is a creditor beneficiary. d. lose, as he is an incidental beneficiary.

Trust Engineering Company is considering the purchase of a new machine to replace an existing one. The old machine was purchased 5 years ago at a cost of $20,000, and it is being depreciated on a straight line basis to a zero salvage value over a 10-year life. The current market value of the old machine is $14,000. The new machine, which costs $30,000, falls into the MACRS 5-year class and has an estimated life of 5 years. The change in depreciation expense that results from accepting the project and will be considered in the capital budgeting analysis is _____. The MACRS rates for 5-year class are Year 1-20%, Year 2-32%, Year 3-19%, Year4-12%, Year 5-11%, Year 6-6%.

A. $10,500 B. $23,400 C. $44,000 D. $20,000 E. $17,000

The maturity matching approach calls for matching the maturities of:?

A. long-term liabilities and equity.? B. ?long-term liabilities and short-term liabilities. C. ?long-term assets and short-term assets. D. ?assets and equity. E. ?assets and liabilities.