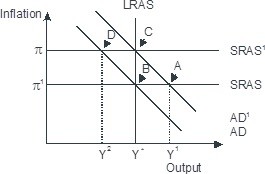

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C

B. D; B

C. A; B

D. B; C

Answer: B

You might also like to view...

A business owner makes 1000 items a day. Each day she spends 8 hours producing those items. If hired, elsewhere she could have earned $250 an hour. The item sells for $15 each. Production occurs seven days a week. If the explicit costs total $150,000 per month, what is her economic profit?

a. $300,000 b. $60,000 c. $450,000 d. $240,000

Stockholders have little incentive to monitor

A) managers. B) stock markets. C) stock prices. D) their portfolios.

Assume that an economy experiences both positive population growth and technological progress. In this economy, which of the following is constant when balanced growth is achieved?

A) I B) S C) Y/N D) all of the above E) none of the above

Explain why proponents of supply-side effects of tax rate variations who also believe that tax-rate changes influence aggregate demand might claim that cuts in marginal income tax rates can potentially push up real Gross Domestic Product (GDP) without generating inflation.

What will be an ideal response?