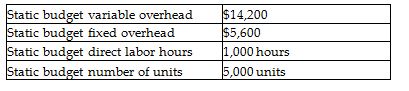

The following information relates to Randolph Manufacturing's overhead costs for the month:

Randolph allocates manufacturing overhead to production based on standard direct labor hours.

Randolph reported the following actual results for last month: actual variable overhead, $14,500; actual fixed overhead, $5,400; actual production of 4,700 units at 0.22 direct labor hours per unit. The standard direct labor time is 0.20 direct labor hours per unit.

Compute the variable overhead efficiency variance. (round the answer to the nearest dollar)

VOH efficiency variance = (AQ - SQ) × SC

= (1,034* - 940**) × $14.20***

= $1,335 U

* 4,700 units produced × 0.22 actual direct labor hours per unit =1,034 DLHr

** 4,700 units produced × 0.20 standard direct labor hours per unit = 940 DLHr

*** Standard VOH allocation rate: Budgeted VOH / Budgeted allocation base

$14,200 / 1,000 = $14.20 per DL Hr

You might also like to view...

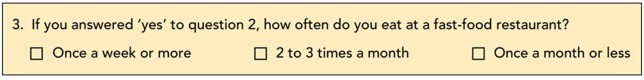

Figure 7-4: Question 3Consider Figure 7-4: Question 3 above, which was part of a Wendy's survey that assessed fast-food restaurant preferences among present and prospective consumers. Question 3 illustrates which type of question format?

Figure 7-4: Question 3Consider Figure 7-4: Question 3 above, which was part of a Wendy's survey that assessed fast-food restaurant preferences among present and prospective consumers. Question 3 illustrates which type of question format?

A. closed-end B. attitudinal C. semantic differential D. open-ended E. dichotomous

Marbry Corporation has provided the following information concerning a capital budgeting project: After-tax discount rate 9%Tax rate 30%Expected life of the project 4 Investment required in equipment$196,000? Salvage value of equipment$0 Annual sales$550,000? Annual cash operating expenses$394,000? One-time renovation expense in year 3$78,000? The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

A. $8,025 B. $32,100 C. $48,150 D. $24,075

Champion Corporation produces and sells a single product. In April, the company sold 1,700 units. Its total sales were $153,000, its total variable costs were $79,900, and its total fixed costs were $56,800.Required:a. Construct the company's contribution format income statement for April in good form.b. Redo the company's contribution format income statement assuming that the company sells 1,600 units.

What will be an ideal response?

If a company uses a predetermined overhead rate, which of the following statements is correct?

A. Manufacturing Overhead will be debited for actual overhead. B. Manufacturing Overhead will be debited for estimated overhead. C. Manufacturing Overhead will be credited for actual overhead. D. Manufacturing Overhead will be credited for estimated overhead.