Explain the effects of a tax cut if the economy is operating on the downward sloping segment of the Laffer curve

Any tax cut would increase tax revenue by increasing incentives to invest and to work. This is because

lower corporate tax rates increase after-tax profit, which induces suppliers to expand production (and

productive capabilities). Also, lower income tax rates encourage more people to work longer, increasing

production.

You might also like to view...

How do price-level factors that change total spending in an economy affect the aggregate demand curve?

a. The curve becomes perfectly vertical. b. The entire curve shifts leftward or rightward. c. The entire curve develops an upward slope. d. There is movement along the curve.

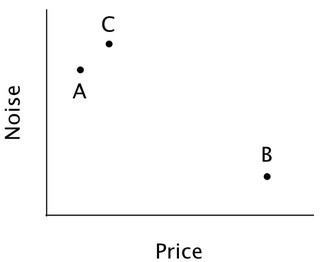

Corey is having difficulty deciding between two dishwashers, A and B. As shown in the accompanying diagram, A makes more noise than B, but is cheaper. Ideally, Corey would like a dishwasher that is both quiet and inexpensive. If Corey behaves like most decision-makers, then the addition of option C would:

If Corey behaves like most decision-makers, then the addition of option C would:

A. increase his likelihood of picking B. B. decrease his likelihood of buying a dishwasher. C. increase his likelihood of picking A. D. have no impact on his choice of A and B.

The fraction, or percentage, of total income which is saved is called the:

a. Marginal propensity to save b. Disposable income schedule c. Saving schedule d. Average propensity to save

Max has allocated $100 toward meats for his barbecue. His budget line and an indifference map are shown in the above figure. What happens if Max's mother gives him 10 pounds of burger?

A) Max would have preferred receiving the dollar value of the burger. B) Max is indifferent between this gift and the dollar value of the burger. C) Max prefers this gift to the dollar value of the burger. D) None of the above.