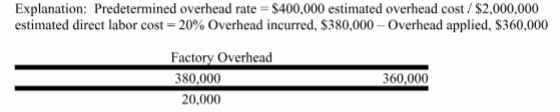

Morris Company applies overhead based on direct labor costs. For the current year, Morris Company estimated total overhead costs to be $400,000, and direct labor costs to be $2,000,000. Actual overhead costs for the year totaled $380,000, and actual direct labor costs totaled $1,800,000. At year-end, the balance in the Factory Overhead account is a:

A) $380,000 Debit balance.

B) $360,000 Debit balance.

C) $20,000 Debit balance.

D) $400,000 Credit balance.

E) $20,000 Credit balance.

C) $20,000 Debit balance.

You might also like to view...

On June 30, 2014, Sonata Company's operating facilities in Nebraska were destroyed by a flood. The loss of $700,000 was not covered by insurance. Sonata's tax rate for 2014 is 40 percent. In Sonata's income statement for the year ended September 30, 2014, this event should be reported as an extraordinary loss of

a. $0. b. $280,000. c. $420,000. d. $700,000.

The costs assigned to the individual assets acquired in a basket purchase are based on their relative:

A. market values. B. depreciable costs. C. historical costs. D. book values.

Transferred- in costs include costs from

a. all prior departments b. the last production cycle c. the last department only d. the current period only

The inclusive work place offers a model for integration with society via ______ of inclusion.

a. expanding policies b. expanding circles c. expanding programs d. expanding opportunities