In a two-period model with default, if the market interest rate is low, then

A) default is more likely

B) there is no effect on the nation's default decision.

C) default is less likely.

D) the income effect is larger than the substitution effect.

C

You might also like to view...

The number of labor union members reached its peak in the decade of the

A. 1950s. B. 1960s. C. 1970s. D. 1980s.

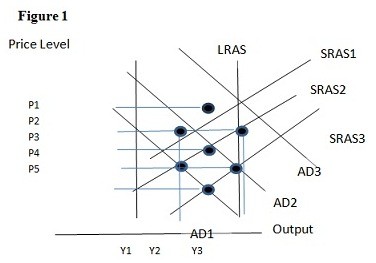

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.

By instituting performance-based rewards to CEOs the profits of firms will:

A. remain constant. B. rise. C. fall. D. None of the statements is correct.

Interest rates are positive because inflation makes purchases more expensive in the future than today

Indicate whether the statement is true or false