The total cost of taxation to consumers and producers generally exceeds the amount of tax revenue collected by government.

Answer the following statement true (T) or false (F)

True

The total cost also includes the deadweight loss.

You might also like to view...

One way the "lemons problem" in the used-car market can be mitigated is by

a. raising the price of used cars. b. hiring auto experts to sell used cars. c. requiring sellers to guarantee trouble-free cars. d. allowing owners to trade in their own cars when they purchase a used car.

A variety of statistical studies based on the U.S. experience suggests that when government borrowing increases by $1, private saving rises by about

a. 10 cents. b. 30 cents. c. 50 cents. d. $1.

Procrastination, addiction, and honesty

a. may be explained by preferences that are not transitive b. violate the economist's assumption that "more is better" c. help to explain why the substitution effect is more powerful than the income effect d. are often inconsistent with narrowly defined rationality e. are inferior economic "goods".

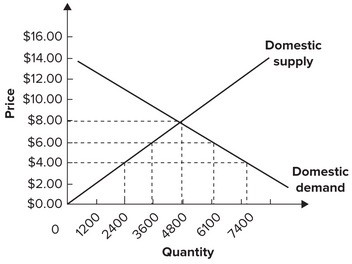

Refer to the graph shown for a small country that is a price taker internationally. Assume the foreign supply of this product is perfectly elastic at a price of $4 per unit. Starting from a free trade equilibrium, a tariff in the amount of $2 per unit would be expected to cause domestic consumption to:

Assume the foreign supply of this product is perfectly elastic at a price of $4 per unit. Starting from a free trade equilibrium, a tariff in the amount of $2 per unit would be expected to cause domestic consumption to:

A. decrease from 7,400 to 6,100. B. decrease from 4,800 to 3,600. C. increase from 2,400 to 7,400. D. increase from 2,400 to 3,600.