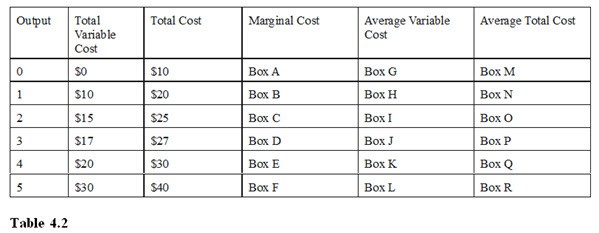

Referring to Table 4.2, Box H should be filled with

A. $10.

B. $30.

C. $20.

D. $0.

Answer: A

You might also like to view...

If a “liberal” wanted to increase aggregate demand, which of the following would he or she tend to favor?

A. An increase in government spending, because it will increase the size of the public sector. B. A decrease in transfer payments, because it keeps the public sector small. C. An increase in transfer payments, because it has a larger multiplier than tax changes. D. A decrease in taxes, because it makes the public sector smaller.

The agency which functions as a "lender of last resort" for national governments is the

A) International Trade Organization. B) International Monetary Fund. C) World Trade Organization. D) World Trade Fund.

If the government increases the income tax rate:

A. disposable income decreases. B. disposable income increases. C. disposable income remains unaffected. D. total income increases.

Which of the following is most clearly consistent with the basic postulate of economics regarding the reaction of people to a change in incentives

a. Farmers produce fewer bushels of wheat in response to an increase in the price of wheat. b. People will buy more milk at a price of $2 per gallon than at $1 per gallon. c. People will buy less gas if the price of gas increases by $.20 per gallon. d. People will consume more beef if the price increases from $1 to $2 per pound.