The net (after tax) profit will be

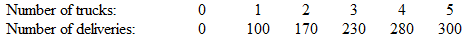

Consider the following production function for a delivery service.

Each delivery generates $200 in gross revenue, and the tax rate is 10 percent on profits. Each truck costs $11,000.

a) $4,500

b) $8,100

c) $10,800

d) $11,700

e) $12,400

d) $11,700

You might also like to view...

An increase in the demand for washing machines might be caused by

A. a decrease in the number of buyers. B. an expected increase in the price of washing machines. C. a decrease in the price of washing machines. D. an expected decrease in the price of washing machines.

Advertising costs are ________ costs and the per unit cost of advertising ________ as production increases

A) fixed; increases B) variable; increases C) fixed; decreases D) variable; does not change

Which one of the following statements is FALSE?

A. ATC = AFC + AVC B. MC = TC divided by Q C. AFC = TFC divided by Q D. TC = TFC + TVC

Refer to Scenario 7.2 below to answer the question(s) that follow. SCENARIO 7.2: You are the owner and only employee of a company that sets odds for sporting events. Last year you earned a total revenue of $100,000. Your costs for rent and supplies were $50,000. To start this business you invested an amount of your own capital that could pay you a return of $20,000 a year. Refer to Scenario 7.2. Your accounting profit last year was

A. $10,000. B. $30,000. C. $50,000. D. $60,000.