Which of the following about Social Security is true?

a. All of the current revenues flowing into the Social Security system are needed for benefit payments to current retirees.

b. If the Social Security surplus was used to pay down the privately held federal debt, this would reduce future taxes and, thereby, make it easier to deal with the retirement of the baby boomers.

c. During the 1980s and 1990s, most of the social security surplus was used to reduce the national debt.

d. When the Social Security surplus is used to cover the current operating expenses of the federal government, it will make it easier for future taxpayers to provide promised Social Security benefits to baby boomers.

B

You might also like to view...

The legislature is at a bargaining disadvantage with a bureau because _____

a. they have many bureaus to oversee b. its members reveal their demand for the good through speeches and public statements c. they typically obtain all their information from the bureau d. all of the above e. a and c

The responsibility of paying for the Social Security benefits for currently retired individuals falls on

A) current and future workers. B) the retired people themselves. C) no one, since the government prints the money. D) only working people over 50 years of age.

When a seller expects the price of its product to decrease in the future, the seller's supply curve shifts left now

a. True b. False Indicate whether the statement is true or false

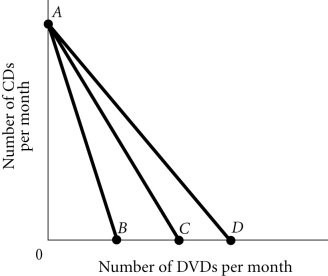

Refer to the information provided in Figure 6.3 below to answer the question(s) that follow. Figure 6.3Refer to Figure 6.3. Molly's budget constraint is AB. It would swivel to AD if the price of

Figure 6.3Refer to Figure 6.3. Molly's budget constraint is AB. It would swivel to AD if the price of

A. CDs decreased. B. DVDs decreased. C. DVDs increased. D. CDs increased.