Personal income taxes are the difference between

A. national income and personal income.

B. net domestic product and personal income.

C. national income and disposable personal income.

D. personal income and disposable personal income.

Answer: D

You might also like to view...

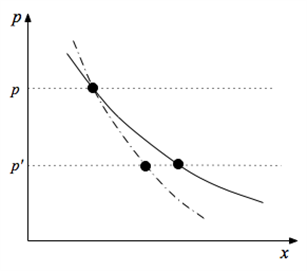

The following graph applies to a consumer for whom good x is an inferior good. The price of x falls from p to p', and one of the curves below represents the consumer's (uncompensated) demand curve while the other represents the consumer's compensated demand (or MWTP) curve.

c. Once the consumer has optimized at the new price p', illustrate the new (uncompensated) demand and the new MWTP curve. d. For curves that have shifted, explain why; for curves that have not shifted, explain why as well. What will be an ideal response?

Let D = demand, S = supply, P = equilibrium price, Q = equilibrium quantity

What happens in the market for sushi if the Surgeon General announces that a majority of the raw fish that is imported to make sushi contains high levels of toxic mercury? A) D decreases, S no change, P and Q decrease B) S decreases, D no change, P increases, Q decreases C) D no change, S increases, P decreases, Q decreases D) D and S decrease, P and Q decrease

According to Irving Fisher, velocity ________

A) is determined by institutions that affect the way individuals transact B) is affected by institutions only gradually C) is assumed constant in the short run D) all of the above E) none of the above

Which of the following market models results in the highest level of consumer surplus assuming a fixed number of firms with identical costs and a given demand curve?

A) Cournot B) Stackelberg C) Monopoly D) Cartel