Annual production and sales level of Product A is 34,300 units, and the annual production and sales level of Product B is 69,550 units. What is the approximate overhead cost per unit of Product A under activity-based costing?

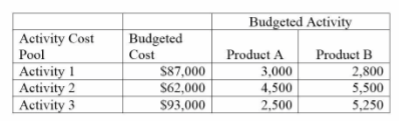

A company has two products: A and B. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools:

A) $3.00

B) $2.00

C) $10.28

D) $15.00

E) $2.33

A) $3.00

Explanation: Activity 1 allocated to Product A line: $87,000 × 3,000/5,800 = $45,000

Activity 2 allocated to Product A line: $62,000 × 4,500/10,000 = $27,900

Activity 3 allocated to Product A line: $93,000 × 2,500/7,750 = $30,000

Total overhead allocated to Product A = $102,900

Overhead per unit of Product A: $102,900/34,300 = $3.00

You might also like to view...

From whom should a CPA not accept a commission for recommending a product or service?

a. A tax client. b. An audit client. c. A financial-planning client. d. A management-services client. e. Any of the above.

Harpo Enterprises maintains the Oprah Winfrey show, a Web site, and O magazine. Because Harpo Enterprises practices integrated marketing communications, these different brand contacts all maintain ________ in design and tone

A) variety B) contact C) consistency D) creativity E) convenience

What are some advantages of specialists?

What will be an ideal response?

Team members have more respect for someone who can lead by example, not from behind a desk.

Answer the following statement true (T) or false (F)