Which of the following does the one-year rule state?

A) Every contract in writing is subject to yearly renewal.

B) The terms of a written contract can be modified within a year of its formation.

C) A contract that cannot be performed on its own terms within a year should be in writing.

D) Valid contracts cannot be rescinded by either party until a year after their formation.

C

You might also like to view...

Explain the detrimental effects a cyberbully can have on someone.

What will be an ideal response?

Joining a line at an airport shoeshine stand where there are five people shining shoes puts you in which type of queuing system line structure?

What will be an ideal response?

The _____ operator could be used in place of INTERSECT if the DBMS does not support it

a. IN b. OF c. AND d. UNION

What would be the non-controlling interest amount in King's Consolidated Net Income for 2018?

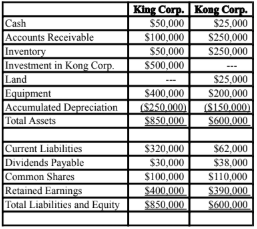

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, which it acquired on January 1, 2018. The Financial Statements of King Corp. and Kong Corp. for the Year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Balance Sheets

Other Information:

> King sold a tract of Land to Kong at a profit of $10,000 during 2018. This land is still the property of Kong Corp.

> On January 1, 2018, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

> On January 1, 2018, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2018, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

> Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

> Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

• Inventory had a fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2018.

• A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

• There was a goodwill impairment loss of $4,000 during 2018.

• Both companies are subject to an effective tax rate of 40%.

• Both companies use straight line amortization.

A) $11,600. B) $8,240. C) $15,000. D) $10,000.