Can central bankers set short-term interest rate targets and still control inflation in the long run or are these goals mutually impossible? Explain.

What will be an ideal response?

They can attain both goals. The monetary policy reaction curve shows that the central bankers can influence aggregate demand and, ultimately inflation by adjusting the real interest rate. In the long run, inflation is determined by money growth. The central bankers can alter their balance sheets and the monetary base in the short run to change the short-term real interest rate. Money growth on the other hand depends on the willingness of central bankers to expand their balance sheets for the long run.

You might also like to view...

In the above figure, if the price is P1 and the firm produces Q2, it is

A) making an economic profit. B) incurring an economic loss. C) breaking even. D) More information is needed to determine if the firm is earning a positive economic profit, zero economic profit, or is incurring an economic loss.

The bond supply curve is ________ sloping, indicating a(n) ________ relationship between the price and quantity supplied of bonds, everything else equal

A) downward; inverse B) downward; direct C) upward; inverse D) upward; direct

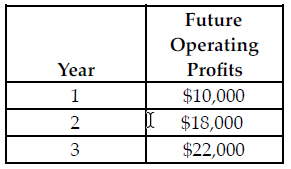

Refer to the table below. If the discount rate is 4 percent and the cost of the investment is $40,000, what is the net present value of the investment?

The above table shows the future operating profits from an investment. The future operating profits are earned at the end of each of the respective years.

A) $44,469.77

B) $5,815.32

C) $45,815.32

D) $6,221.77

The most numerous or plentiful firms in the United States are found in this form of business

A) partnership. B) proprietorship. C) monopoly. D) corporation.