A survey of CEOs of the 162 largest firms on Fortune's list of the 500 largest American corporations found that the CEOs strongly believed that

A. all business students should major in international business.

B. international business skills and knowledge were critical for promotion to senior executive positions in all companies.

C. foreign language proficiency should be required of all business students.

D. international business skills and knowledge were important for appointment to entry-level positions.

E. an international orientation should be an important part of a college business education, but only for those students planning to work internationally.

Answer: D

You might also like to view...

After running up a lot of credit card debt, Mort wants to make a "fresh start" by obtaining a Chapter 7 liquidation bankruptcy. Mort discovered that his family's income is below that of the median family income for a family the size of Mort's family in his state. As such, Mort qualifies to obtain a discharge of debts under Chapter 7 because ________.

A. he passed the mean income test B. he passed the median income test C. he passed the undue hardship test D. he passed the mini/max test

Which of the following is true of an aggressive funding strategy of a firm?

A) Under an aggressive funding strategy, a firm funds it seasonal requirements with bonds and long-term loans. B) Under an aggressive funding strategy, a firm funds its seasonal requirements with short-term debt. C) Under an aggressive funding strategy, a firm funds both its seasonal and its permanent requirements with long-term debt. D) Under an aggressive funding strategy, a firm funds it permanent requirements with commercial paper and notes payable.

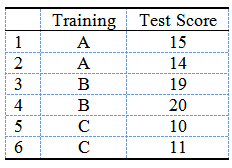

In the table below, “19” is a…

a. data

b. datum

c. dataset

d. variable

If a company made a bank deposit on September 30 that did not appear on the bank statement dated September 30, in preparing the September 30 bank reconciliation, the company should:

A. Add the deposit to the book balance of cash. B. Deduct the deposit from the bank statement balance. C. Skip the bank reconciliation this month. D. Deduct the deposit from the September 30 book balance and add it to the October 1 book balance. E. Add the deposit to the bank statement balance.