The payroll tax system is a proportional tax for all income earners.

Answer the following statement true (T) or false (F)

False

You might also like to view...

Refer to Figure 17-5 to answer the following questions

a. What is the equilibrium quantity of firefighters hired, and what is the equilibrium wage? b. What is the equilibrium quantity of paralegals hired, and what is the equilibrium wage? c. Explain why firefighters might earn a higher weekly wage than paralegals. d. Suppose that comparable worth legislation is passed, and the government requires that firefighters and paralegals be paid the same wage, $800 per week. Now how many firefighters will be hired and how many paralegals will be hired?

What factors constitute the primary determinants of income?

What will be an ideal response?

National income accounting can best be characterized as:

a. a set of rules used to summarize economic activity over a given period of time. b. a method for comparing different political systems. c. a microeconomic model of the economy used by the Federal Reserve bank. d. a statistical measure of the income received by consumers as opposed to businesses. e. a standardized economic report authored by politicians.

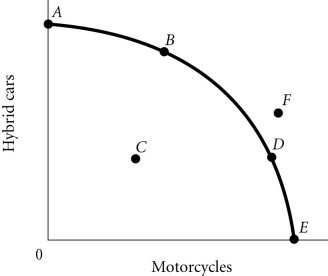

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, as the economy moves from Point B to Point D, the opportunity cost of motorcycles, measured in terms of hybrid cars,

Figure 2.4According to Figure 2.4, as the economy moves from Point B to Point D, the opportunity cost of motorcycles, measured in terms of hybrid cars,

A. increases B. remains constant. C. initially increases, then decreases. D. decreases.