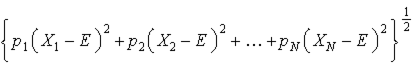

Suppose you are an investor with a choice between three securities that are identical in every way except in terms of their rates of return and risk. Which security has the least risk? Note: You can answer this question intuitively, without calculating the standard deviation. However, if you want to calculate the standard deviation, the equation is:

Standard deviation = S =

A. Investment A

B. Investment B

C. Investment C

D. Investment D

Answer: D

You might also like to view...

In a feminine culture (Hofstede), there is relatively less ________________ between male and female roles, which suggests that leadership and decision-making roles are equally open to men and women.

Fill in the blank(s) with the appropriate word(s).

Masde Corporation produces and sells Product CharlieD. To guard against stockouts, the company requires that 25% of the next month's sales be on hand at the end of each month. Budgeted sales of Product CharlieD over the next four months are: JuneJulyAugustSeptemberBudgeted sales in units40,00060,00050,00080,000?Budgeted production for August would be:

A. 77,000 units B. 57,500 units C. 80,000 units D. 107,000 units

Using complete sentences and the use of "I" are essential in creating an effective resume

Indicate whether the statement is true or false.

What is OLAP? Explain its features

What will be an ideal response?