The supply-side effects of a change in taxes on labor income means that ________ in taxes on labor income shifts the ________

A) an increase; labor supply curve leftward

B) a decrease; labor demand curve rightward

C) an increase; labor supply curve rightward

D) a decrease; labor demand curve leftward

E) an increase; labor supply curve leftward and the labor demand curve rightward

A

You might also like to view...

In the above figure, if the economy is at equilibrium at E1, the Fed would most likely

A) attempt to lower the aggregate demand in the economy. B) attempt to lower the price level below 120. C) adopt an expansionary monetary policy. D) adopt a contractionary monetary policy.

Which of the following is the largest component of national income?

A) net interest B) compensation of employees by firms C) corporate profits D) rental income

Recall the Application about how marginal utility changes with the quantity consumed to answer the following question(s). Neuroscientists offered subjects in an experiment varying monetary rewards, and observed the neural activity in a subject's striatum region of the brain.Recall the Application. The larger the monetary reward offered to the subjects in the experiment:

A. the higher the marginal utility and total utility of the reward money. B. the lower the marginal utility and total utility of the reward money. C. the lower the marginal utility and higher the total utility of the reward money. D. the higher the marginal utility and lower the total utility of the reward money.

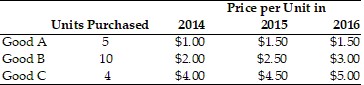

Refer to the information provided in Table 22.6 below to answer the question(s) that follow.

Table 22.6 Refer to Table 22.6. If 2014 is the base period, the price index in 2014 is

Refer to Table 22.6. If 2014 is the base period, the price index in 2014 is

A. 1000. B. 100. C. 10. D. 1.