What would be the amount appearing on the December 31, 2018 Consolidated Statement of Financial Position for deferred income taxes?

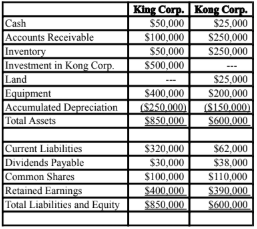

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, which it acquired on January 1, 2018. The Financial Statements of King Corp. and Kong Corp. for the Year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Balance Sheets

Other Information:

> King sold a tract of Land to Kong at a profit of $10,000 during 2018. This land is still the property of Kong Corp.

> On January 1, 2018, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

> On January 1, 2018, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2018, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

> Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

> Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

• Inventory had a fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2018.

• A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

• There was a goodwill impairment loss of $4,000 during 2018.

• Both companies are subject to an effective tax rate of 40%.

• Both companies use straight line amortization.

A) $11,200. B) $10,000. C) Nil. D) $12,000.

D) $12,000.

You might also like to view...

One reason The Richards Group has been successful at creating award-winning campaigns is:

A) the creation of teams of creatives working on the same project B) the agency hires experienced creatives C) the agency comingles employees to create interdisciplinary villages D) the use of professional production companies to shoot ads

Jogg Corp plant operates five days per week with a daily payroll of $50,000 . Employees are paid every Tuesday for the prior week's work (Monday through Friday). The last day of the month is Tuesday, April 30 . What effect does the accrual at April 30 have on Pub's net income?

a. Increase by $250,000 b. Decrease by $150,000 c. Decrease by $100,000 d. Increase by $150,000

Orville Redenbacher popcorn yielded deep consumer insights from its ________ research, which suggested that the essence of popcorn was that it was a "facilitator of interaction."

A) cognitive B) inductive C) archaeological D) ethnographic E) deductive

One of the weaknesses of the direct write-off method is that it

A) understates accounts receivable on the balance sheet B) violates the matching principle C) is too difficult to use for many companies D) is based on estimates