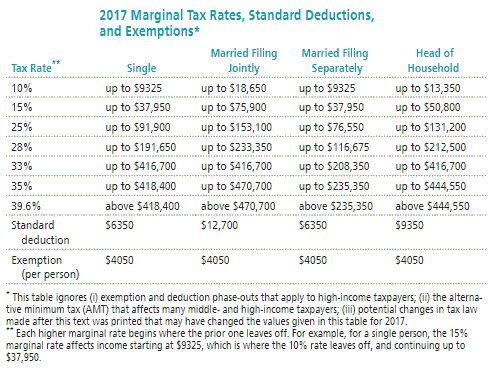

Solve the problem. Refer to the table if necessary. Carl is single and has a taxable income of $38,367. Calculate the amount of tax owed.

Carl is single and has a taxable income of $38,367. Calculate the amount of tax owed.

A. $5331

B. $5304

C. $9592

D. $4203

Answer: A

You might also like to view...

Provide an appropriate response.Which of the following will contribute to an increased federal debt?

A. Increasing receipts B. Decreasing Social Security benefits C. Increasing international aid D. Raising taxes

Solve the problem.Suppose you start saving today for a  down payment that you plan to make on a condo in 4 years. Assume that you make no deposits into the account after your initial deposit. The account has quarterly compounding and an APR of 6%. How much would you need to deposit now to reach your

down payment that you plan to make on a condo in 4 years. Assume that you make no deposits into the account after your initial deposit. The account has quarterly compounding and an APR of 6%. How much would you need to deposit now to reach your  goal in 4 years?

goal in 4 years?

A. $6893.39 B. $5893.39 C. $5969.40 D. $6304.25

Solve the equation using the addition principle.a - 7 = 1

A. -6 B. -8 C. 6 D. 8

What is the formula to compute the present value of a single sum?

What will be an ideal response?