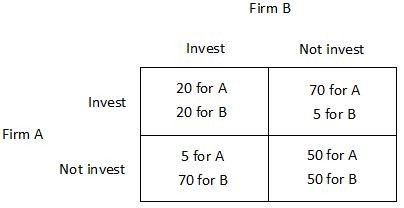

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  An industry spy comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. How much must the spy pay B?

An industry spy comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. How much must the spy pay B?

A. At least $35 million

B. At least $50 million

C. $0

D. At least $15 million

Answer: D

You might also like to view...

Even though Mexico is a developing country, the NAFTA market is very rich

Indicate whether the statement is true or false

Refer to Table 4.2. If you choose to invest in Japanese bonds, your investment return from Scenario C will be

A) -3%. B) -1%. C) 2%. D) 5%.

One advantage of ad valorem taxes over unit taxes is that _____

a. the tax is more difficult to evade b. the tax is easier to collect c. the tax increases with inflation d. the tax automatically adjusts for inflation

Which of the following illustrates the tragedy of the commons?

a. Overharvesting a species of fish b. Banning the use of oil and gas c. Using coal for manufacturing d. Hunting out of season