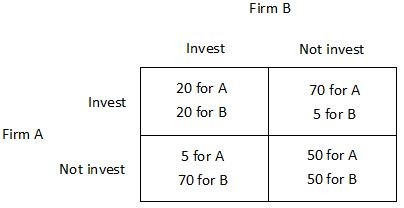

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital. An industry spy from firm A comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. What is the most that firm A will be willing to pay B to not invest?

An industry spy from firm A comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. What is the most that firm A will be willing to pay B to not invest?

A. $50 million

B. $20 million

C. $35 million

D. $30 million

Answer: A

You might also like to view...

Assume that an economy's real GDP multiplier is 2 and that this economy is in equilibrium at $500 billion. If the government wants to move this economy to full-employment at $600 billion, while maintaining a balanced budget, it must choose which of the following options?

a. Increase government spending and taxes by $100 billion b. Decrease government spending and taxes by $100 billion c. Increase government spending and taxes by $200 billion d. Decrease government spending and taxes by $200 billion

What is a firm's short run supply curve?

What will be an ideal response?

According to the law of demand, ceteris paribus,

A. The responsiveness of consumer demand to a change in the price of a good is measured by the price elasticity of demand. B. A consumer will purchase more of a good at higher prices than at lower prices. C. The quantity demanded increases at lower prices. D. Price and quantity supplied are directly related.

When the price of a good decreases, the budget constraint shifts out parallel to the original budget constraint.

Answer the following statement true (T) or false (F)