The federal funds rate is:

a. the minimum amount of reserves the Fed requires a bank to hold.

b. the interest rate that the Fed charges banks who borrow from it.

c. the interest rate on loans made by banks to other banks

d. the maximum percentage of the cost of a stock that can be borrowed from a bank, with the stock offered as collateral.

e. an appeal by the Fed to banks, asking for voluntary compliance with the Fed's wishes.

c

You might also like to view...

The ability to produce a good at a lower opportunity cost than someone else is called

A) competitive production. B) comparative advantage. C) selective advantage. D) absolute advantage.

Which of the following is evidence of an inflationary gap?

a. very long lines at employment agencies b. very short waiting times for product delivery c. very low sales figures d. very long search times for people looking for jobs e. very low unemployment rates

Positive economics seeks to:

A. determine what government economic policies are best. B. objectively explain how societies value different economic outcomes. C. determine the most appropriate economic goals for society. D. objectively explain how the economy functions.

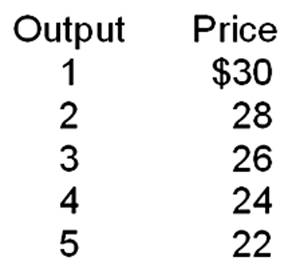

If the marginal cost were $22, the firm would maximize its profit at _____ unit(s) of output.

A. 1

B. 2

C. 3

D. 4