Find the Social Security tax (6.2%), Medicare tax (1.45%), and state disability insurance deduction (1%) for the employee. Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that  is paid for any overtime in a

is paid for any overtime in a  week. Round to the nearest cent if needed. Hours Reg FICA Medicare SDIEmployee Worked Rate Tax Tax TaxHudson, R. 41.94 $7.92

week. Round to the nearest cent if needed. Hours Reg FICA Medicare SDIEmployee Worked Rate Tax Tax TaxHudson, R. 41.94 $7.92

A. $20.59, $4.82, $3.32

B. $21.07, $4.93, $3.40

C. $19.64, $4.59, $3.17

D. $30.89, $7.22, $4.98

Answer: B

Mathematics

You might also like to view...

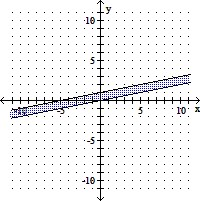

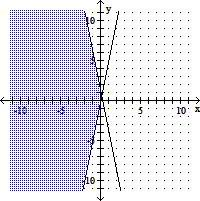

Graph each system of inequalities and shade the portion of the graph represented by the solution set..

A.

B.

C.

D.

Mathematics

Find all solutions of the equation in the interval [0, 2?).csc2 = 2

A.

B.

C.

D.

Mathematics

Use polar coordinates to find the limit of the function as (x, y) approaches (0, 0).f(x, y) =

A. 2 B. 1 C. 0 D. No limit

Mathematics

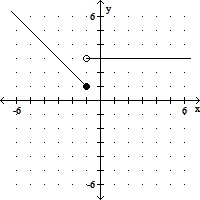

Graph the piecewise linear function.f(x) =

A.

B.

C.

D.

Mathematics