We would expect, all else equal, that:

A. taxes would have no effect on unemployment.

B. taxes would be negatively related to unemployment.

C. lower taxes would reduce unemployment.

D. higher taxes would reduce unemployment.

Answer: C

You might also like to view...

XYZ Gadget Company is currently considering which investment projects it should undertake. The following list of projects along with the estimated rate of return of each project is presented to the executive management team:Project A (9%)Project B (7.5%)Project C (6%)Project D (11%)Project E (5.5%)The current interest rate in the loanable funds market is 7%. However, the government is considering an increase in government borrowing to implement fiscal policy. How high would interest rates need to go to induce the company to drop all but one of its planned investment projects?

A. Above 9% B. Above 7% C. Above 7.5% D. Above 11%

The Fed directly controls long-term interest rates

Indicate whether the statement is true or false

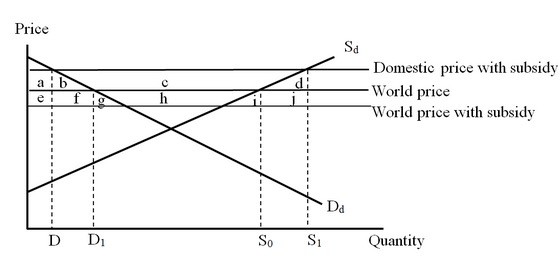

The figure below illustrates the impact of an export subsidy as imposed by a large country. No imports are permitted. The consumption effect of the export subsidy is shown by area(s)

The consumption effect of the export subsidy is shown by area(s)

A. (d + i + j). B. b. C. (b + f + g). D. d.

The Smoot-Hawley Tariff

A) lowered U.S. tariffs by 50 percent following World War II. B) was passed by the U.S. Congress following the Civil War as a means of increasing government revenue. C) was passed by the U.S. Congress upon a recommendation made by the General Agreement on Tariffs and Trade (GATT) in 1948. D) raised average tariff rates by over 50 percent in the United States in 1930.