Refer to Table 18-6. Sasha is a single taxpayer with an income of $60,000. What is his marginal tax rate and what is his average tax rate?

A) marginal tax rate = 17%; average tax rate = 21% B) marginal tax rate = 23%; average tax rate = 38%

C) marginal tax rate = 38%; average tax rate = 23% D) marginal tax rate = 38%; average tax rate = 24%

D

You might also like to view...

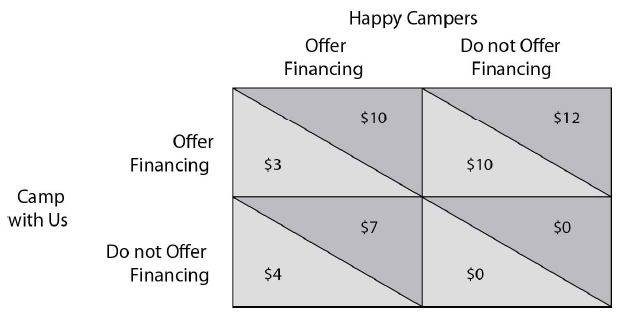

Refer to the payoff matrix below. In reference to the Nash equilibrium/equilibria in this game, which of the following is true?

Camp with Us and Happy Campers compete in the market for campers. Each firm must decide each season if they are going to offer special financing or not. The above payoff matrix shows each firm's net economic profit at each pair of strategies.

A) Camp with Us Offer Financing and Happy Campers Offer Financing is a Nash equilibrium.

B) There are no Nash equilibria in this game.

C) Camp with Us Do Not Offer Financing and Happy Campers Offer Financing is a Nash equilibrium.

D) Camp with Us Do Not Offer Financing and Happy Campers Do Not Offer Financing is a Nash equilibrium.

What is the natural rate of unemployment, and how does it relate to the concept of potential (or full-employment) GDP?

The marginal utilities associated with the first 4 units of consumption of good Y are 10, 12, 9, and 7, respectively. What is the total utility associated with the third unit?

A. 3. B. 9. C. 25. D. 31.

A key decision that all firms make is which technology to use in the production of their products.

Answer the following statement true (T) or false (F)