Chelsea wants to start her own Christmas ornament business. She can purchase a suitable factory that costs $100,000 . Chelsea currently has $150,000 in the bank earning 3 percent interest per year. Suppose Chelsea purchases the factory using $50,000 of her own money and $50,000 borrowed from a bank at an interest rate of 6 percent. What is Chelsea's annual opportunity cost of purchasing the

factory?

a. $2,000

b. $3,000

c. $4,500

d. $5,000

c

You might also like to view...

Airline deregulation led to the demise of many smaller airlines but large carriers were not materially affected

a. True b. False Indicate whether the statement is true or false

The second largest source of income for the federal budget is:

a. personal income taxes. b. corporate income taxes. c. payroll taxes. d. inheritance taxes.

If the probability of an outcome equals one, the outcome:

A. is certain to occur. B. has unquantifiable risk. C. is more likely to occur than the others listed. D. is certain not to occur.

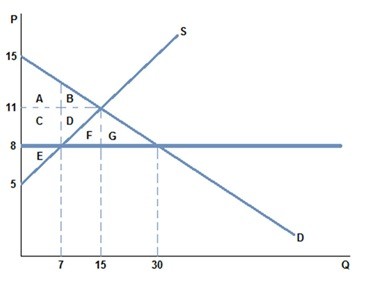

If a price ceiling of $8 were placed in the market in the graph shown:

If a price ceiling of $8 were placed in the market in the graph shown:

A. some surplus is transferred from consumer to producer. B. all consumers are made better off. C. some surplus is transferred from producer to consumer. D. all producers are made better off.