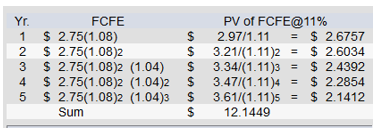

The growth in per share FCFE of SYNK, Inc. is expected to be 8% per year for the next two years, followed by a growth rate of 4% per year for three years. After this five-year period, the growth in per share FCFE is expected to be 3% per year, indefinitely. The required rate of return on SYNC, Inc. is 11%. Last year's per share FCFE was $2.75. What should the stock sell for today?

A. $28.99

B. $35.21

C. $54.67

D. $56.37

E. $39.71

E. $39.71

Calculations are shown below.

You might also like to view...

___________are the crucial link between economic transactions entered into by an entity and the accounting for these events

Fill in the blank(s) with correct word

The ________ distinguishes retail outlets based on whether independent retailers, corporate chains, or contractual systems own the outlet.

A. form of ownership B. product assortment C. wheel of retailing D. service level E. merchandise line

An ethical guideline for dealing with confidential information is not to pass it along unless the welfare of others is at stake

Indicate whether the statement is true or false.

On June 14, Sure-Fit Shoe Store sold $12,000 of merchandise that cost $8,000 and accepted credit cards as payment. Sure-Fit electronically transmitted the credit card forms to the credit card company which charges a 3% fee to handle such transactions. On June 18, Sure-Fit received the proceeds from the credit card company.Required:a) Prepare the entry to record the sale of the merchandise on June 1 in general journal format.b) Prepare the journal entry to record the credit card proceeds on June 18 in general journal format.

What will be an ideal response?