Refer to Table 4.2. If you choose to invest in Japanese bonds, your investment return from Scenario D will be

A) 1%.

B) 3%.

C) 7%.

D) 13%.

A

You might also like to view...

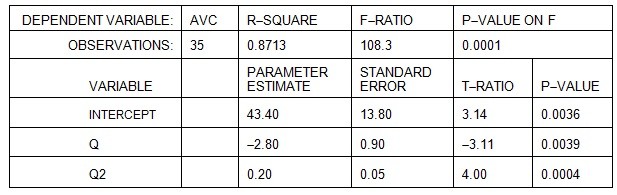

Straker Industries estimated its short-run costs using a U-shaped average variable cost function of the formAVC = a + bQ + cQ2and obtained the following results. Total fixed cost (TFC) at Straker Industries is $1,000.  If Straker Industries produces 20 units of output, what is estimated total variable cost (TVC)?

If Straker Industries produces 20 units of output, what is estimated total variable cost (TVC)?

A. $2,348 B. $1,498 C. $1,348 D. $4,428

given the list of assets which is most liquid

a. $500 worth of General Motors common stock b. $500 worth of General Motors bonds c. a $500 traveler's check d. a one-ounce gold coin

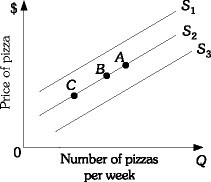

Refer to the information provided in Figure 3.10 below to answer the following question(s). Figure 3.10Refer to Figure 3.10. An increase in the wage rate of pizza makers will cause a movement from Point B on supply curve S2 to

Figure 3.10Refer to Figure 3.10. An increase in the wage rate of pizza makers will cause a movement from Point B on supply curve S2 to

A. Point A on supply curve S2. B. supply curve S1. C. Point C on supply curve S2. D. supply curve S3.

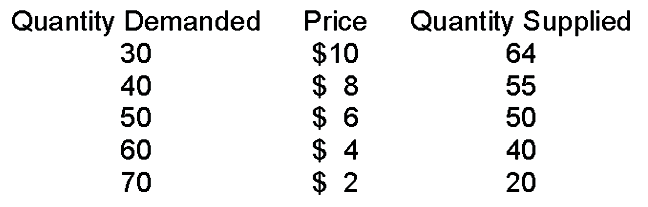

When price is $2

A. there is a surplus.

B. there is a shortage.

C. quantity demanded is less than quantity supplied.

D. price must fall to get to equilibrium.