Suppose you would have to pay Troy at least $12 to get him to part with his new water bottle. Loss aversion implies that if Troy had not yet purchased the water bottle, he would:

A. be willing to pay exactly $12 to buy it.

B. no longer be interested in buying it.

C. be willing to pay less than $12 to buy it.

D. be willing to pay more than $12 to buy it.

Answer: C

You might also like to view...

A currency revaluation is a(n):

A. increase in the value of a currency relative to other currencies. B. increase in the official value of a currency in a fixed-exchange-rate system. C. decrease in the value of a currency relative to other currencies. D. reduction in the official value of a currency in a fixed-exchange-rate system.

Given a price elasticity of demand of -0.33, a decrease in price will

A) reduce total revenue. B) increase total revenue. C) leave total revenue unchanged. D) decrease quantity.

Nick has $300 a month to spend on detailing his sports car or buying bottles of good wine. It costs $100 to have his car detailed and $50 for a bottle of wine. He currently buys four bottles of wine and has his car detailed once a month. If the price of detailing his car decreased to $75, Nick's budget constraint:

A. would shift straight outward, because he is relatively wealthier. B. would rotate and change slope because relative prices have changed. C. would shift straight inward because he is relatively wealthier. D. One cannot determine what would happen without knowing Nick's marginal utility of each good.

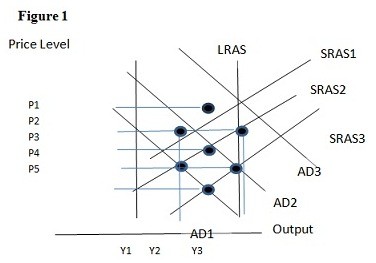

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.