Several writers have helped to popularize the notion that stock prices follow no discernible pattern. What is meant by a random walk, and how can you explain why people continue to invest in stocks if the random walk theory is correct?

What will be an ideal response?

The random walk theory holds that stock prices cannot be predicted with any certainty. Although evidence supports the random walk idea, stocks have tended to move to higher values over time. So while the short-term walk may be random, the long-term trend is still up and the return generally higher than other alternatives, such as bonds or savings accounts.

You might also like to view...

The Fed fights inflation by _______

A. lowering the federal funds rate, which lowers interest rates and de-creases aggregate demand B. raising the federal funds rate, which raises interest rates and decreases aggregate demand C. decreasing the monetary base, which raises the interest rate and in-creases saving D. lowering the long-term real interest rate, which increases investment and spurs economic growth

In the case against AT&T, it was forced to give up its ______________.

Fill in the blank(s) with the appropriate word(s).

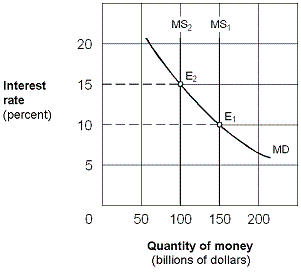

Exhibit 20-1 Money market demand and supply curves

?

A. higher investment, lower real GDP, and lower price level. B. lower investment, lower real GDP, and lower price level. C. higher investment, higher real GDP, and higher price level. D. higher interest rate and no effect on real GDP or the price level.

Which of the following statements applies to a purely competitive producer?

A. It will not advertise its product. B. In long-run equilibrium it will earn an economic profit. C. Its product will have a brand name. D. Its product is slightly different from those of its competitors.