What does the following journal entry indicate? Legal Expense..................2,900 Cash...............................2,900

a. $2,900 cash is due to an attorney.

b. A sum of $2,900 was received from attorney in advance.

c. $2,900 cash is due from an attorney.

d. An attorney was paid $2,900 in cash.

d

FEEDBACK: a. Incorrect

b. Incorrect.

c. Incorrect.

d. Correct.

You might also like to view...

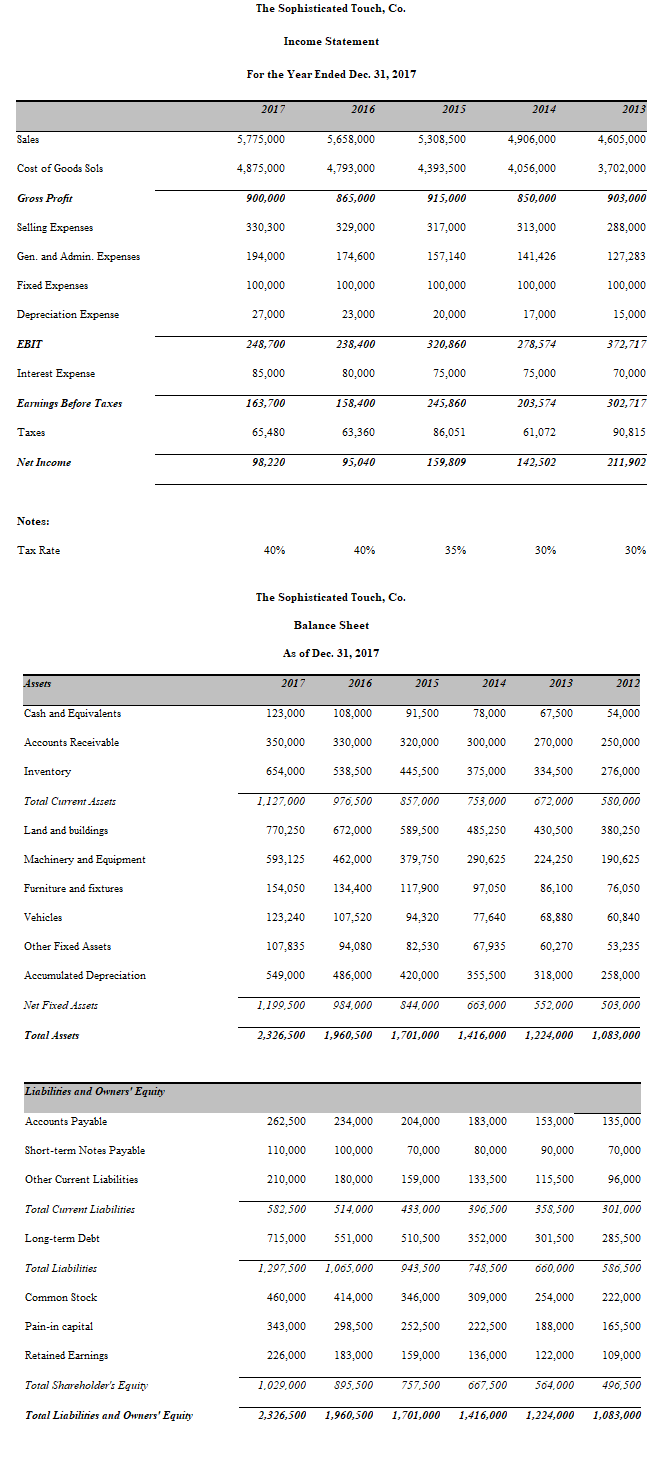

The Sophisticated Touch, Co., a catering company, wants to evaluate its historical financial data over the last five years.

a) Set up a ratio worksheet similar to Exhibit 3-6, page 92, and calculate all of the ratios for The Sophisticated Touch, Co.

b) Verify the change in 2017 Sophisticated Touch, Co.’s ROE using the Du Pont method.

c) Using the Altman’s model for privately held firms and public ones, calculate the Z-score for The Sophisticated Touch, Co. Assume that the market value of equity is $1,500,000; $1,250,000; $1,000,000; $850,000; and $700,000 for the years 2017, 2016, 2015, 2014, and 2013 respectively.

d) Calculate the economic profit for these years and compare it to net income. Assume that the WACC is 12% each year.

e) The staff at The Sophisticated Touch, Co. wants to perform a trend analysis with the data generated in the previous sections of this problem. Create a line chart showing each category of ratios from 2013 to 2017. Make sure to title the chart and label the axes. Also make a line chart of the Altman’s model for private and public firms from 2013 to 2017.

Burns, a married man, died leaving a will in which he left his entire estate to his two children and three nephews. Is his wife entitled to a share in the estate?

Chojnowski Incorporated makes a single product-a cooling coil used in commercial refrigerators. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Budgeted (Planned) Overhead: Budgeted variable manufacturing overhead$82,450 Budgeted fixed manufacturing overhead 325,975 Total budgeted manufacturing overhead$408,425 Budgeted production (a) 25,000unitsStandard hours per unit (b) 1.70labor-hoursBudgeted hours (a) × (b) 42,500labor-hours Applying Overhead: Actual production (a) 20,000unitsStandard hours per unit (b) 1.70labor-hoursStandard hours allowed for the actual production (a) ×

(b) 34,000labor-hours Actual Overhead and Hours: Actual variable manufacturing overhead$74,812 Actual fixed manufacturing overhead 312,975 Total actual manufacturing overhead$387,787 Actual hours 31,700labor-hoursThe predetermined overhead rate is closest to: A. $9.61 per labor-hour B. $16.34 per labor-hour C. $19.39 per labor-hour D. $11.41 per labor-hour

Telephones send ___ _______ signals whereas computers send _ _______ signals

Fill in the blank(s) with the appropriate word(s).