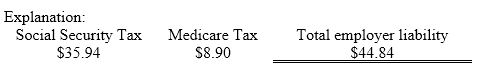

On a recent paycheck, Mayim's taxes were as follows: Federal withholding, $32; Social Security tax, $35.94; Medicare, $8.90; and state income tax, $10.50. What is the employer's share for these taxes?

A) $87.34

B) $55.34

C) $44.84

D) $35.94

C) $44.84

You might also like to view...

Logos help with in-store shopping because:

A) they are more readily recognized by shoppers B) they move traffic past goods which are not being purchased C) they are a form of clutter D) consumers have made up their minds prior to arrival

Which of the following techniques help to create a positive telephone image?

A. End the call abruptly since it is essential to respect the customer's time. B. Continually evaluate yourself since you are your own best critic. C. Use a canned or mechanical presentation to gain the customer's attention. D. Adopt a flippant approach when the customer gets unreasonable.

Dino Corp. is a start-up located in Orlando. It offers highly beneficial pension plans to its employees. Which category of employees is the company most likely to attract through its pension benefits?

A. young people B. disabled workers C. women of childbearing age D. unmarried people E. older people

Termeer Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.InputsStandard Quantity or Hours per Unit of OutputStandard Price or RateVariable manufacturing overhead0.30 hours$2.30 per hourThe company has reported the following actual results for the product for August: Actual output 8,000unitsActual direct labor-hours 2,380hoursActual variable overhead rate$2.10per hourActual variable overhead cost$4,998 The variable overhead rate variance for the month is closest to:

A. $480 U B. $476 F C. $476 U D. $480 F