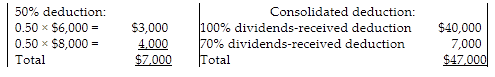

Parent and Subsidiary Corporations are members of an affiliated group. Their separate taxable incomes (before taking into account any dividends) are $75,000 and $85,000, respectively. Subsidiary Corporation receives a dividend from a less-than-20%-owned corporation of $8,000 and from an affiliated 100%-owned nonconsolidated insurance subsidiary of $40,000. Subsidiary distributes a dividend of

$35,000 to Parent Corporation who also receives dividends of $6,000 from a less-than-20%-owned corporation. The consolidated dividends-received deduction is what?

What will be an ideal response?

You might also like to view...

Many of our present financial statement figures would be misleading if it were not for the going concern assumption

Indicate whether the statement is true or false

The Securities and Exchange Commission (SEC) has the right granted to it by Congress to issue accounting standards. The Commission has exercised this right on a relatively infrequent basis. The SEC is not a passive observer to the financial accounting

standard setting process, however. Explain the general mission of the SEC and how the SEC fulfills its mission as regards financial reporting specifically.

Uncertainty avoidance is more important in the United States than it is in Japan or Italy

Indicate whether the statement is true or false

Inadequate recognition can be a major stressor.

Answer the following statement true (T) or false (F)