Automatic stabilizers stabilize the level of real GDP because:

a. Congress quickly changes spending and tax revenue.

b. federal expenditures and tax revenues change as the level of real GDP changes.

c. the spending and tax multiplier are constant.

d. wages are controlled by the minimum wage law.

b

You might also like to view...

If the firms in an oligopoly collude, the results will approximate what other type of industry?

a. perfect competition b. monopolistic competition c. monopoly d. none of the above

Which of the following is true?

a. Marginal tax rates that take a large share of income will enhance the incentive of individuals to invest and engage in productive activities. b. High tax rates will tend to drive investment funds and highly productive citizens to other countries where tax rates are lower. c. As marginal tax rates increase, individuals get to keep a larger share of their earnings. d. Countries can gain by imposing higher tariffs and other barriers that will restrain international trade.

Which of the following is NOT a supply-side policy?

A. Decrease taxes B. Cut government spending C. Balance the budget D. Increase government spending in response to a deflationary gap

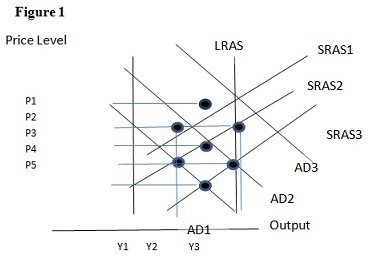

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD3 the result in the short run would be:

A. P1 and Y2. B. P2 and Y3. C. P3 and Y1. D. P2 and Y2.