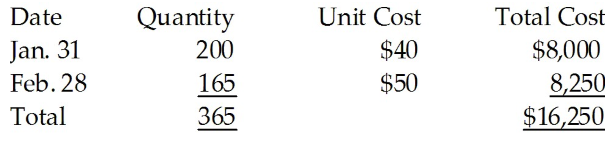

A company purchased 200 units for $40 each on January 31. It purchased 165 units for $50 each on February 28. It sold 225 units for $65 each from March 1 through December 31. If the company uses the last-in, first-out inventory costing method, what is the amount of Cost of Goods Sold on the income statement for the year ending December 31? (Assume that the company uses a perpetual inventory system.)

A) $10,650

B) $8,250

C) $8,000

D) $16,250

A) $10,650

Number of units sold = 225 units of which 165 units were purchased on Feb. 28 at $50 per unit and 60 units were purchased on Jan. 31 at $40 per unit.

Cost of Goods Sold = (165 units x $50)+(60 units x $40) = $8,250+$2,400=$10,650

You might also like to view...

For each objective provided in an MPR plan, there should be at least one corresponding statement of tactics

Indicate whether the statement is true or false

Which of the following accounts should be closed to Income Summary at the end of the fiscal year?

A) Merchandise Inventory B) Accumulated Depreciation C) Drawing D) Cost of Merchandise Sold

What is the role of information systems?

a. To develop needed information and get it to the right people b. To make sure all employees understand what’s going on in the organization c. To keep employees accountable for mistakes they may be making d. To develop annual reports for shareholders

Mintzberg’s approach suggests that strategists formulate strategy from _________.

a. The newspapers b. Textbooks c. Strategic thinking tools d. Consultancy models