In Country X, the government requires employers to collect 9 percent of every employee's compensation as payroll tax. This is an example of

a. progressive tax.

b. regressive tax.

c. digressive tax.

d. proportional tax.

d

You might also like to view...

When the government cuts the income tax rate, the real wage rate paid by employers ________ and the real wage rate received by workers ________ and potential GDP ________

A) increases; increases; increases B) decreases; decreases; increases C) increases; decreases; increases D) decreases; increases; decreases E) decreases; increases; increases

The idea that rational employers think at the margin is central to understanding how many units of labor they choose to employ

a. True b. False Indicate whether the statement is true or false

A supply-side economist would recommend a cut in marginal tax rates on capital gains and on investment expenditures

A. When the economy is in a recession. B. if government spending is cut by an equal amount. C. if it is judged that the resulting deficit will not crowd out very much investment. D. regardless of the state of the economy or other policies.

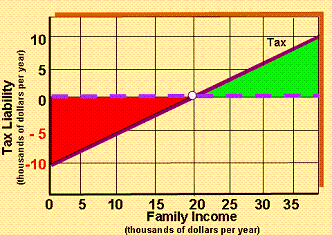

Exhibit 12-9 Negative Income Tax

A. zero payment B. the break-even income of $20,000 C. a $10,000 payment D. a $10,000 tax deferment