The tax cuts of 1981 and 1986

a. stimulated the economy and tax revenues increased to eliminate deficits

b. stimulated the economy as supply-side economists predicted it would

c. depressed the economy as supply-side economists predicted it would

d. had neither a noticeable stimulating nor depressing effect on the economy

e. were found to be unconstitutional and so couldn't have had the effect on the economy that the President had hoped

D

You might also like to view...

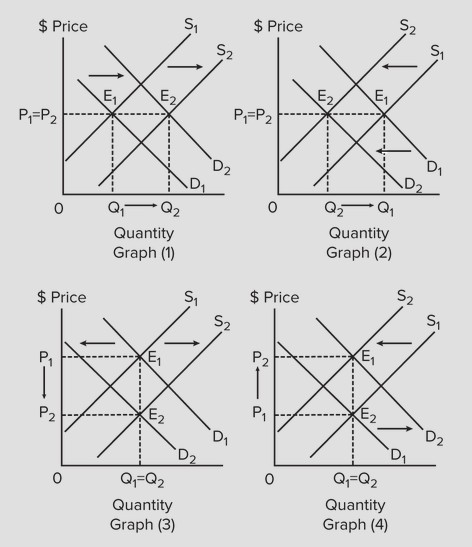

Refer to the following graphs to answer the question below. In which graph would the indicated shifts cause equilibrium quantity to definitely rise, but the effect on price is indeterminate?

In which graph would the indicated shifts cause equilibrium quantity to definitely rise, but the effect on price is indeterminate?

A. graph (1) B. graph (2) C. graph (3) D. graph (4)

Assume that GDP = $10,000 and the MPC = 0.75. If policy makers want to increase GDP by 30 percent, and they want to change taxes and government spending by equal amounts, how much would government spending and taxes each need to increase?

A) $300 B) $750 C) $1,000 D) $3,000

Which of the following is not a characteristic of oligopoly?

A) the ability to influence price B) a small number of firms C) interdependent firms D) low barriers to entry

Countries with floating exchange rates have certain characteristics. Indicate the one that does not apply to those countries

A) closed economy B) small economy C) diversified trade D) divergent inflation rates