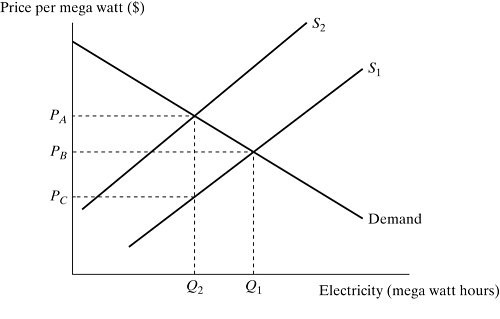

Figure 9.9 depicts a market for electricity. S1 is the supply curve without the external costs. S2 is the supply curve with the $T tax. Assume electricity production incurs external costs. If the government imposes the pollution tax in the amount illustrated, the amount of the pollution tax shifted forward on to consumers is:

Figure 9.9 depicts a market for electricity. S1 is the supply curve without the external costs. S2 is the supply curve with the $T tax. Assume electricity production incurs external costs. If the government imposes the pollution tax in the amount illustrated, the amount of the pollution tax shifted forward on to consumers is:

A. PA - PB.

B. PA - PC.

C. PB - PC.

D. (1/2)?(PB - PC).

Answer: A

You might also like to view...

An export good is a good produced

A) in the United States and sold in other countries. B) in the United States and sold to foreigners living in the United States. C) in another country and purchased by U.S. residents. D) by foreigners in the United States and purchased by U.S. households. E) in another country and purchased by foreigners not residing in the United States.

According to Keynes, during extreme times like deep recessions, which group is the only one possessing the power and resources to move aggregate demand?

a. Consumers b. Producers c. Government d. Investors

Those who view education as a sorting mechanism emphasize that employers value the

A. skills that people who attend college have already acquired before they enter college. B. docility and deference to authority learned in the classroom. C. analytic ability of the highly educated worker. D. work habits picked up in the home and school.

Consider 45 risk-neutral bidders who are participating in a second-price, sealed-bid auction. It is commonly known that bidders have independent private values. Based on this information, we know the optimal bidding strategy for each bidder is to:

A. bid one penny above their own valuation to ensure they get the item. B. bid according to the following bid function: b = v ? (v ? L)/n. C. shade their bid to just below their own valuation. D. bid their own valuation of the item.