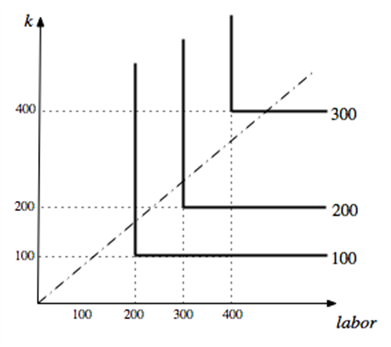

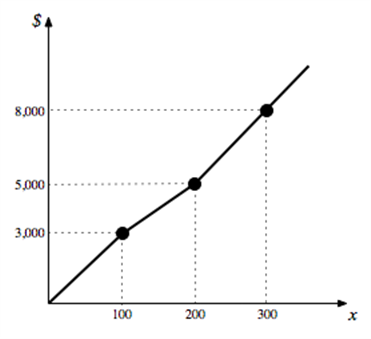

Suppose capital and labor are perfect complements in production. For output levels between 0 and 100, 2 units of labor together with 1 unit of capital produce 1 unit of output; for output levels between 100 and 200, 1 unit of labor together with 1 unit of capital produces 1 unit of output; and for output levels above 200, 1 unit of labor together with two units of capital produces one additional output. In each graph below, carefully label as much of each graph as you can.

a. On a graph with labor on the horizontal axis and capital on the vertical, illustrate isoquants for 100, 200 and 300 units of output.

b. Is this production technology homothetic?

c. Suppose the wage and rental rates are 10. On a graph with output on the horizontal axis and dollars on the vertical, plot the total (long run) cost of producing 100, 200 and 300 units of output and illustrate the total cost curve.

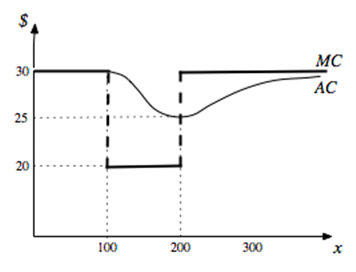

d. On a separate graph with output on the horizontal and dollars on the vertical axis, illustrate the (long run) marginal cost curve and the approximate shape of the long run average cost curve.

What will be an ideal response?

b. Since there are rays from the origin along which the technical rate of substitution changes, this technology is not homothetic.

c.

d.

You might also like to view...

The consumption function shows the relationship between planned real consumption spending and

A) planned real saving. B) the average propensity to consume. C) real disposable income. D) the marginal propensity to consume.

You choose to get a flu shot each fall and your roommate chooses not to get a flu shot. For your roommate, you getting a flu shot is a

A) positive externality. B) negative externality. C) transactions cost. D) property right.

The government of Putania spent $67,000,000 in a particular year, and the total tax receipts of the government in that year were $120,000. Calculate the budget deficit

A) $600,000 B) $680,000 C) $67,120,000 D) $66,880,000

If the interest rate in the United States rises

A) investors increase their demand for dollars and the U.S. exchange rate appreciates. B) investors increase their demand for dollars and the U.S. exchange rate depreciates. C) investors decrease their demand for dollars and the U.S. exchange rate appreciates. D) investors decrease their demand for dollars and the U.S. exchange rate depreciates.