Determine (a) the before-tax ROR, and (b) approximate after-tax ROR for a project that has a first cost of $750,000, a salvage value of 25% of the first cost after 3 years, and annual (GI-OE) of $260,000. Assume the company has a Te of 37%.

What will be an ideal response?

(a) Before-tax ROR: 0 = -750,000 + 260,000(P/A,i*,3) + 187,500(P/F,i*,3)

i* = 12.60%

(b) Approximate after-tax ROR = (before-tax ROR) (1-Te)

= 12.60(1 – 0.37)

= 7.94%

You might also like to view...

When using a drill press, make sure the workpiece is _____.

a. secured to the table b. free to move c. lubricated d. upside down

In the Town House, as you enter the dining room and kitchen, the floor material changes.

Answer the following statement true (T) or false (F)

Whose work on crowd psychology demonstrated the power of charismatic leaders to galvanize mob action?

a. Gustave Le Bon b. Max Weber c. Émile Durkheim d. Henri Bergson

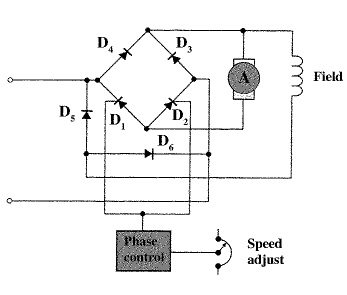

In the above figure, the SCRs in the variable voltage DC drive perform which of the following functions?

In the above figure, the SCRs in the variable voltage DC drive perform which of the following functions?

A. rectification B. varies armature current C. voltage regulation D. both a and b E. all of the above