If the government removes a tax on a good, then the quantity of the good sold will

a. increase.

b. decrease.

c. not change.

d. All of the above are possible.

a

You might also like to view...

An increase in government expenditures by $100 (unmatched by an increase in taxes) would, if the MPC = 0.9, result in an increase in national income by

a. $1,000 b. $9,000 c. $900 d. $190 e. inadequate information is given

Other things the same, the aggregate quantity of output supplied will decrease if the price level

a. is lower than expected so that firms believe the relative price of their output has increased. b. is lower than expected so that firms believe the relative price of their output has decreased. c. is higher than expected so that firms believe the relative price of their output has increased. d. is higher than expected so that firms believe the relative price of their output has decreased.

Which of the following statements regarding price floors is TRUE?

a. Price floors always benefit consumers and harm producers. b. Price floors make markets more efficient, but they diminish profit levels. c. Price floors result in shortages. d. Price floors are intended to help certain people, but they have side effects that may harm others in predictable ways.

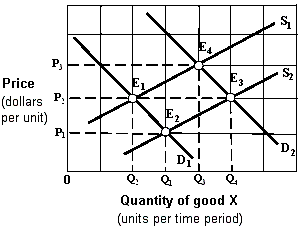

Exhibit 4-2 Supply and demand curves

A. E1 to E2. B. E1 to E3. C. E4 to E1. D. E3 to E4.