Economists generally believe that tax credits and deductions that are used to create an incentive for individuals to go to college

A. cause no more people to go to college, amounting to a special break for people who would have gone to college anyway.

B. cause a few more people to go to college, working somewhat as was intended.

C. perversely cause fewer people to go to college.

D. cause dramatically more people to go to college, working precisely as was intended.

Answer: A

You might also like to view...

A more conservative stockholder will choose to hold preferred stock rather than common stock

Indicate whether the statement is true or false

If a good is considered "inferior" then:

(a) As its price rises, less of it will be bought. (b) As its price falls, more of it will be purchased. (c) As the consumer's income increases less of the good is purchased. (d) As the consumer's income increases more of the good is purchased.

The supply function for good X is given by Qxs = 200 + 4PX - 3PY - 5PW, where PX is the price of X, PY is the price of good Y and PW is the price of input W. If PX = 500, PY = 250, PW = 30, then the supply curve is

A. Qxs = 1300. B. Qxs = -700 + 4Px. C. Qxs = 150 + 4Px. D. Qxs = -550 + 4Px.

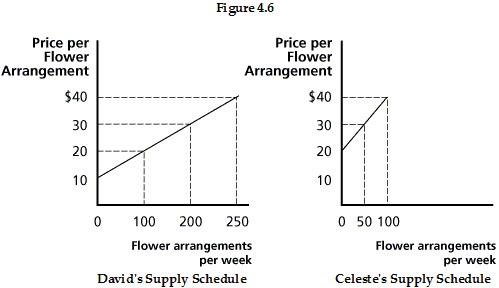

Refer to Figure 4.6, which shows David's and Celeste's individual supply curves for flower arrangements per week. Assuming David and Celeste are the only producers in the market, what is the market quantity supplied at a price of $30?

Refer to Figure 4.6, which shows David's and Celeste's individual supply curves for flower arrangements per week. Assuming David and Celeste are the only producers in the market, what is the market quantity supplied at a price of $30?

A. 200 B. 250 C. 300 D. 350