Which statement about portfolio diversification is correct?

A. Proper diversification can eliminate systematic risk.

B. The risk-reducing benefits of diversification do not occur meaningfully until at least 50-60 individual securities have been purchased.

C. Because diversification reduces a portfolio's total risk, it necessarily reduces the portfolio's expected return.

D. Typically, as more securities are added to a portfolio, total risk would be expected to decrease at a decreasing rate.

E. None of the statements are correct.

D. Typically, as more securities are added to a portfolio, total risk would be expected to decrease at a decreasing rate.

Diversification can eliminate only nonsystematic risk; relatively few securities are required to reduce this risk, thus diminishing returns result quickly.

You might also like to view...

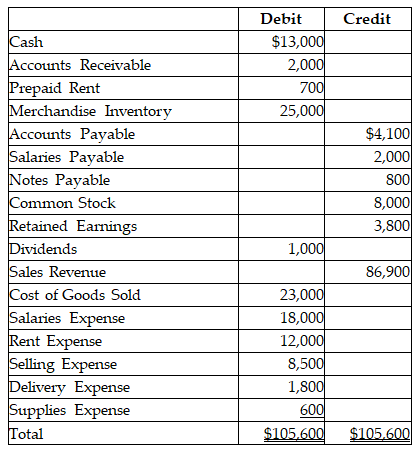

What will be the final balance in the corporation's Retained Earnings account after recording the closing entries?

An adjusted trial balance is given below.

A) $25,800

B) $26,800

C) $14,000

D) $2,800

A balance sheet account that is usually reported at fair value is

A) Marketable Securities. B) Land. C) Accounts Payable. D) Inventory.

A _____ is responsible for managing an organization's computer operating systems.

A. database administrator B. webmaster C. systems analyst D. system administrator

Porter Plumbing's stock had a required return of 11.75% last year, when the risk-free rate was 5.50% and the market risk premium was 4.75%. Then an increase in investor risk aversion caused the market risk premium to rise by 2%. The risk-free rate and the firm's beta remain unchanged. What is the company's new required rate of return? (Hint: First calculate the beta, then find the required return.)

A. 14.38% B. 14.74% C. 15.11% D. 15.49% E. 15.87%