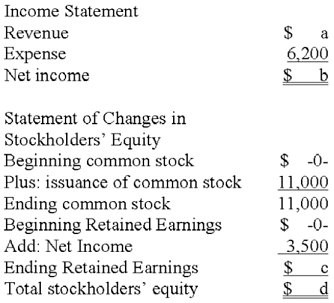

The following is a partial set of financial statements prepared for the company's first year of operations. All transactions were for cash.Required:Fill in the missing information by determining the amounts represented by letters a through d.

What will be an ideal response?

a) $9,700, b) $3,500, c) $3,500, d) $14,500

You might also like to view...

The data presented below is for Craft, Inc for 2015. Credit sales during the year $2,100,000 Accounts receivable—December 31, 2015 295,000 Allowance for doubtful accounts—December 31, 2015 28,000 Bad debt expense for the year 17,000 What amount will Craft show on its year-end balance sheet for the net realizable value of its accounts receivable?

a. $295,000 b. $267,000 c. $250,000 d. $ 28,000

On January 1, 2018, Tyson Manufacturing Corporation purchased a machine for $40,000,000. Tyson's management expects to use the machine for 33,000 hours over the next six years. The estimated residual value of the machine at the end of the sixth year is $47,000. The machine was used for 4000 hours in 2018 and 5500 hours in 2019. What is the depreciation expense for 2018 if the corporation uses the units-of-production method of depreciation? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $4,842,800 B) $13,333,333 C) $6,658,850 D) $4,848,480

The direct write-off method

a. recognizes losses from uncollectible accounts in the period when a firm decides that specific customers' accounts are uncollectible. b. does not usually recognize the loss from uncollectible accounts in the period in which the sale occurs and the firm recognizes revenue. c. provides firms with an opportunity to manage earnings each period by deciding when particular customers' accounts become uncollectible. d. all of the above. e. none of the above.

The mode that represents the highest percentage of U.S. transportation cost in recent years is ______.

a. air b. pipelines c. water d. truck