Which of the following accurately describes the tax treatment of municipal bonds?

A) All income from municipal bonds is tax free.

B) Interest is tax free, but unrealized capital gains are taxable.

C) Interest is tax free, but realized capital gains are taxable.

D) Interest is taxable, but capital gains are tax free.

C

You might also like to view...

If the Fed wishes to reduce nominal interest rates, it must engage in an open market ________ of bonds to ________ the money supply.

A. sale; decrease B. purchase; decrease C. sale; increase D. purchase; increase

The typical state spends the most on

a. education. b. Medicare and Social Security. c. highways. d. defense.

Voters are making a choice to spend money on three projects: a dam, a school, or a road. In the choice between the dam and the school, the majority favors the school. In a choice between a dam and a road, the majority favors a dam. In a choice between a road and a school, the majority favors a road. These rankings indicate that majority voting may:

A. Result in economically efficient outcomes because of rent-seeking behavior B. Reflect irrational preferences C. Produce inconsistent choices D. Lead to consistent choices in spite of irrational community preferences

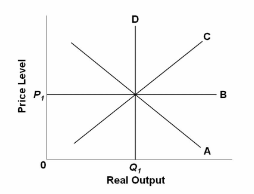

Refer to the diagram. Assume both upward and downward price and wage flexibility in the economy. In the extended AD-AS model:

A. demand-pull inflation would involve a rightward shift of curve A, followed by a rightward

shift of curve C.

B. cost-push inflation would involve a leftward shift of curve C, followed by an upward shift of

curve B.

C. recession would involve a leftward shift of curve A.

D. a rightward shift of curve D would be equivalent to an outward shift of the nation's production possibilities curve.