Briefly explain how a U.S. company that exports to Europe can hedge against exchange rate risk

What will be an ideal response?

It can sell euros forward for dollars at the current forward rate or have its bank carry out the transaction for a fee.

You might also like to view...

Tobacco prices fell dramatically in the early 1600s in spite of demand increases because:

a. supply was also increasing. b. supply was decreasing. c. new farming machinery was introduced. d. the colonial government provided agriculture subsidies for tobacco farmers.

If a good is inferior, its

A. Income elasticity of demand is positive. B. Cross-price elasticity is negative. C. Price elasticity of demand is negative. D. Income elasticity of demand is negative.

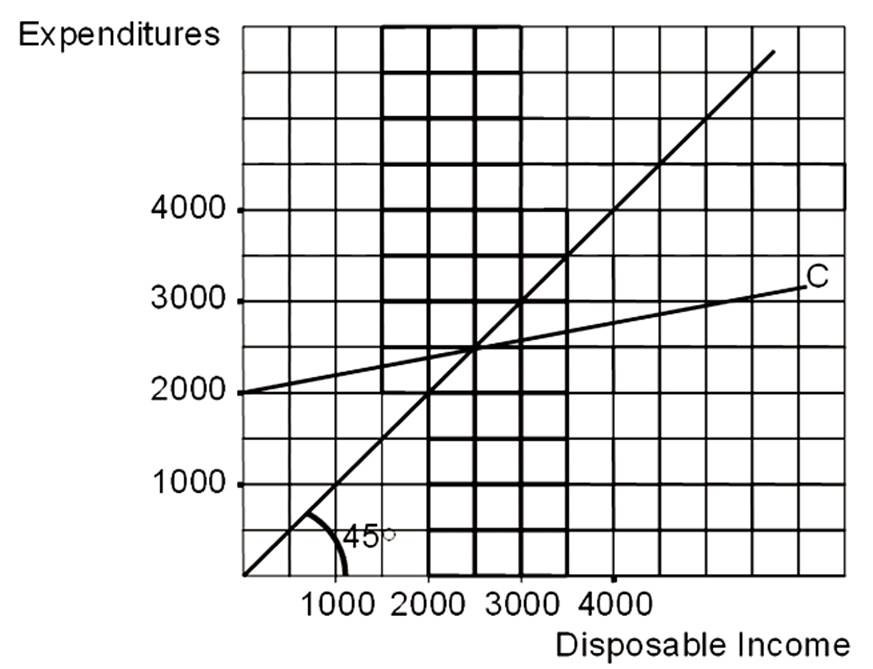

When disposable income is 1250, saving is

A. -1000.

B. -500.

C. 0.

D. 500.

What are the main differences between adverse selection and moral hazard in the insurance market?

What will be an ideal response?