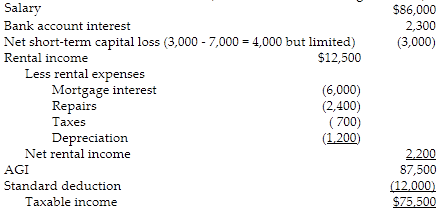

Compute Donna's taxable income. (Show all calculations in good form.)

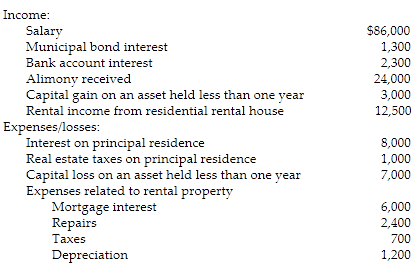

During the current year, Donna, a single taxpayer (divorced in 2018), reports the following items of income and expenses:

Both the municipal bond interest and the alimony received are excluded income. The mortgage interest and real estate taxes on the principal residence are allowed as itemized deductions, but the standard deduction provides a larger deduction from AGI.

You might also like to view...

Individuals who are motivated by a need for ______ tend to seek leadership roles, whereas people motivated by a need for ______ do not.

a. power; achievement b. affiliation; achievement c. power; affiliation d. achievement; power

Lois Lane has owned and operated a consulting business for five years. She guarantees a loan that her husband, Clark Kent, a mild-mannered reporter, takes out in order to buy some real estate as an investment

Note that Lois will not benefit directly from this investment. The investment fails, the husband declares bankruptcy, and the bank sues Lois on her guarantee. Lois pleads undue influence. Which of the following statements is TRUE? A) There is a presumption of undue influence when a wife acts as a guarantee for her husband. B) There is a presumption of undue influence when a bank takes a guarantee from a party who receives no benefit from the main transaction (the subject of the loan). C) Lois must establish undue influence on the fact of this particular case. D) The fact that Lois has her own business is likely to negatively impact any claim of undue influence. E) Both C and D

A business firm's profits may suffer if the firm is not a "good corporate citizen."

Answer the following statement true (T) or false (F)

Jenna and Todd Alder are closing on their home. Their GFE disclosure put their closing costs at $4,200. When they arrive for their closing, the escrow agent explains that their closing costs will be $5,800. To determine whether there is a RESPA violation of the GFE, what will you need to know?

A)?Whether Jenna and Todd have a FHA or conventional loan because RESPA GFE does not apply to conventional loans B)?Whether Jenna and Todd chose their own loan originator C)?Whether they are using cash for the closing fees D)?Both b and c