Solve the problem. Assume no employee earned over $110,000. Use a FICA rate of 6.2%, a Medicare rate of 1.45%, and a FUTA rate of 6.0% of the first $7000 in earnings.The payroll at Mary's Video is $29,762.08. During the same time period, $2069.60 was withheld as income tax. Find the total amount due the IRS.

A. $4450.57

B. $4761.93

C. $6533.91

D. $6623.20

Answer: D

Mathematics

You might also like to view...

Evaluate the function.Find f(a - 3) when f(x) = x2 + 4

A. a2 - 6a + 9 B. a2 + 1 C. a2 + 9 D. a2 - 6a + 13

Mathematics

Solve the problem.If the area of the seed triangle in the construction of the Koch snowflake is 10, then the area of the Koch snowflake is

A. 20. B. infinite. C. 0. D. 16. E. none of these

Mathematics

Represent the quantity with an integer.losing 56 cents

A. -56 B. +56

Mathematics

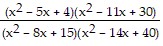

Perform the indicated operations and simplify the result. Leave the answer in factored form. ?

?

A.

B.

C.

D.

Mathematics