Stacey and Eva each own one-half of the stock in Parakeet Corporation, a calendar year taxpayer. Cash distributions from Parakeet are $350,000 to Stacey on April 1 and $150,000 to Eva on May 1. If Parakeet’s current E & P is $60,000, how much is allocated to Eva’s distribution?

A. $5,000

B. $10,000

C. $18,000

D. $30,000

E. None of these.

Answer: C

You might also like to view...

The greater the ________ of a purchase, the higher the consumer's level of involvement will be

A) perceived risk B) cognitive dissonance C) psychographics D) heuristics E) targeting

Exceptions to the use of the inductive approach for bad news messages include

a. messages addressing an insignificant matter. b. memos sent within the company. c. oral presentations. d. all of the above.

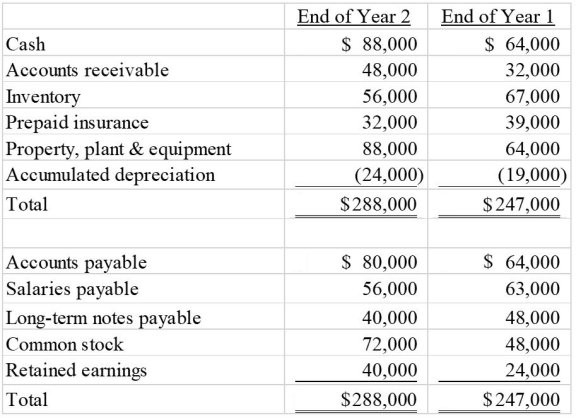

Use the information below to answer the following question(s):The following data is supplied from the comparative balance sheets and income statement information from Moreno, Inc. Net income for Year 2 was $40,000. No long-term assets were sold and no new notes were issued during Year 2. During Year 2, Moreno paid dividends of $24,000. Consider the information provided. Required:Prepare the investing activities section of Moreno's statement of cash flows.

Consider the information provided. Required:Prepare the investing activities section of Moreno's statement of cash flows.

What will be an ideal response?

Identify four employee appraisal feedback sources in addition to an employee's direct manager. What might be a downside of incorporating this additional information?

What will be an ideal response?